How to Get Your Child a Cash App Card: A Parent’s Guide

In today’s increasingly digital world, teaching children about financial responsibility is more important than ever. One way to introduce kids to managing their own money is through tools like the Cash App card. This article provides a comprehensive guide for parents on how to get your child a Cash App card, covering eligibility, setup, safety considerations, and alternative options. We aim to provide clear, accurate, and actionable information to help you make informed decisions about your child’s financial education.

Understanding Cash App and Its Features for Teens

Cash App, developed by Block, Inc., is a popular mobile payment service that allows users to send and receive money, invest in stocks and Bitcoin, and use a debit card linked to their Cash App balance. While primarily used by adults, Cash App also offers features tailored for teenagers, including the ability to have their own Cash App accounts and debit cards, with parental supervision.

Key Features for Teen Accounts:

- Cash App Card: A customizable debit card that teens can use for purchases both online and in physical stores.

- Direct Deposit: Teens can receive direct deposits from paychecks, making it easier to manage their earnings.

- Peer-to-Peer Payments: Allows teens to send and receive money from friends and family, making it convenient for allowances or reimbursements.

- Parental Supervision: Parents can monitor their teen’s account activity and set spending limits.

Eligibility Requirements for a Teen Cash App Card

Before you can proceed with getting a Cash App card for your child, it’s crucial to understand the eligibility requirements. Cash App imposes specific age restrictions and parental consent protocols to ensure responsible usage.

Age Restrictions:

To be eligible for a Cash App account and card, your child must be at least 13 years old. This age restriction is in place to comply with the Children’s Online Privacy Protection Act (COPPA) and other regulations designed to protect minors online.

Parental Sponsorship:

If your child is between 13 and 17 years old, they will need a parent or legal guardian to sponsor their Cash App account. This means the parent must have their own Cash App account and approve the teen’s request to create an account. The parent’s account will be linked to the teen’s account, allowing them to monitor activity and manage settings.

Step-by-Step Guide: How to Get Your Child a Cash App Card

The process of getting a Cash App card for your child involves several steps, from creating the teen account to ordering and activating the card. Here’s a detailed guide to walk you through the process:

Step 1: Parent Setup (If You Don’t Already Have Cash App)

- Download Cash App: Download the Cash App from the App Store (iOS) or Google Play Store (Android).

- Create an Account: Open the app and follow the prompts to create your own Cash App account. You will need to provide your phone number or email address and create a secure PIN.

- Verify Your Identity: Cash App may require you to verify your identity by providing additional information such as your full name, date of birth, and Social Security number. This is to comply with anti-money laundering regulations.

Step 2: Teen Account Creation

- Teen Downloads Cash App: Have your child download the Cash App on their smartphone.

- Teen Starts Account Creation: Your child should start the account creation process, entering their phone number or email address.

- Parental Approval Request: Cash App will prompt the teen to request approval from a parent. The teen will need to enter the parent’s Cash App username or phone number.

Step 3: Parental Approval

- Receive Approval Request: As the parent, you will receive a notification within your Cash App account requesting approval for your child’s account.

- Review and Approve: Review the terms and conditions for teen accounts, and then approve the request. By approving, you are agreeing to supervise your child’s account activity.

Step 4: Ordering the Cash App Card

- Access Card Tab: Once the teen’s account is approved, they can access the card tab within the Cash App.

- Customize the Card: Cash App allows users to customize their card with drawings, emojis, or their Cash App username (cashtag).

- Order the Card: Follow the prompts to order the card. You will need to provide a shipping address where the card will be sent.

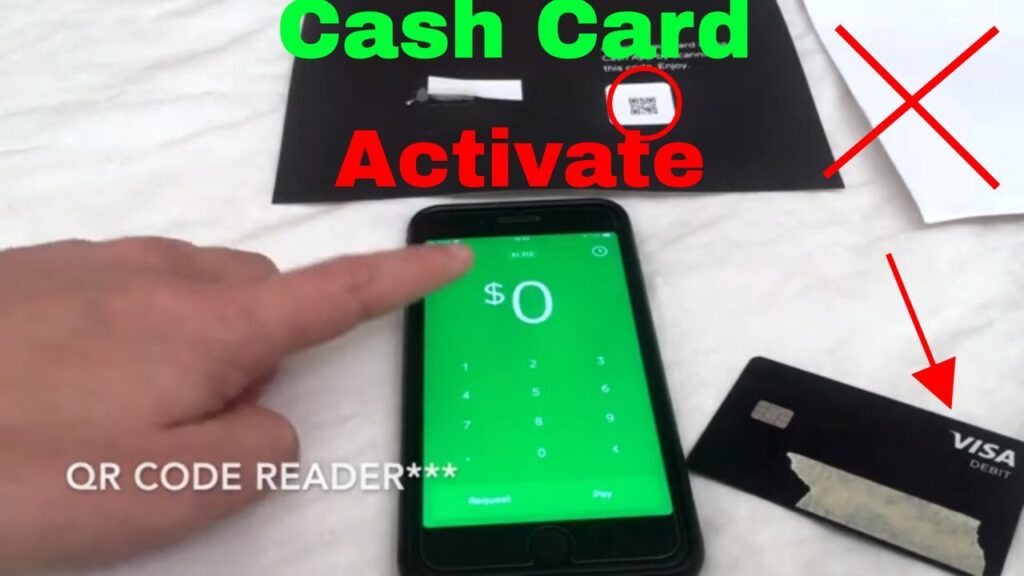

Step 5: Activating the Cash App Card

- Receive the Card: Once the card arrives in the mail, your child will need to activate it through the Cash App.

- Activate the Card: Open the Cash App and go to the card tab. Follow the prompts to activate the card by entering the CVV code on the back of the card.

Setting Spending Limits and Monitoring Activity

One of the key benefits of the Cash App card for teens is the ability for parents to monitor their spending and set limits. This feature helps teens learn about budgeting and responsible spending habits.

Setting Spending Limits:

Parents can set daily or weekly spending limits for their teen’s Cash App card. This can be done through the parent’s Cash App account by accessing the settings for the teen’s account. You can adjust the spending limit based on your child’s needs and your financial goals.

Monitoring Activity:

Cash App provides parents with a detailed transaction history of their teen’s account. You can view all purchases, payments, and transfers made with the Cash App card. This allows you to keep track of your child’s spending habits and identify any potential issues or unauthorized transactions.

Safety Considerations and Potential Risks

While the Cash App card can be a useful tool for teaching financial literacy, it’s essential to be aware of the potential risks and take precautions to ensure your child’s safety. Here are some safety considerations to keep in mind:

Phishing Scams:

Cash App users, including teens, can be targeted by phishing scams. Scammers may attempt to trick users into providing their login credentials or other sensitive information. Teach your child to be cautious of suspicious emails or messages and never share their PIN or password with anyone.

Unauthorized Transactions:

If your child’s Cash App card is lost or stolen, there is a risk of unauthorized transactions. Make sure your child understands the importance of keeping their card secure and reporting any lost or stolen cards immediately. You can also disable the card through the Cash App to prevent further use.

Privacy Concerns:

Like any online platform, Cash App collects user data, including transaction history and personal information. Review Cash App’s privacy policy to understand how your child’s data is being used and take steps to protect their privacy. [See also: Online Privacy for Teens]

Alternatives to the Cash App Card

While Cash App is a popular option, there are several alternative debit cards and financial apps designed for teens. Here are a few alternatives to consider:

- Greenlight: Greenlight is a debit card and financial literacy app specifically designed for kids and teens. It offers features such as parental controls, spending limits, and educational resources.

- GoHenry: GoHenry is another popular debit card and app that allows parents to manage their child’s spending and set savings goals. It also includes features like chore tracking and allowance automation.

- BusyKid: BusyKid is a chore and allowance app that also offers a debit card for kids. It allows parents to assign chores, pay allowances, and track their child’s spending and saving habits.

The Benefits of Using a Cash App Card for Teens

Using a Cash App card can provide several benefits for teenagers, helping them develop essential financial skills and independence. Here are some of the key advantages:

Financial Literacy:

Using a debit card like the Cash App card can teach teens about budgeting, saving, and responsible spending habits. By managing their own money, they can learn to make informed financial decisions and avoid overspending. Having a Cash App card is a good way to have them be more aware of their finances.

Convenience:

The Cash App card provides a convenient way for teens to make purchases both online and in physical stores. It eliminates the need to carry cash and makes it easier to track spending.

Independence:

Having their own Cash App card can give teens a sense of independence and responsibility. They can manage their own money and make their own purchasing decisions, with parental oversight. Getting a Cash App card can foster financial independence.

Parental Control:

The parental control features offered by Cash App allow parents to monitor their teen’s spending and set limits, ensuring responsible usage. Parents can feel secure knowing they have oversight of their child’s financial activity when they get your child a Cash App card.

Conclusion

Getting a Cash App card for your child can be a valuable step in teaching them about financial responsibility and independence. By following the steps outlined in this guide, you can set up a Cash App account for your teen, order a card, and monitor their spending. Remember to prioritize safety and take precautions to protect your child from potential risks. Consider exploring alternative options and choosing the debit card and financial app that best fits your family’s needs. Ultimately, the goal is to empower your child with the knowledge and skills they need to manage their finances effectively and make informed decisions throughout their lives. Understanding how to get your child a Cash App card is the first step.

Before deciding to get your child a Cash App card, consider all the pros and cons. Weigh the benefits of financial literacy against potential risks such as phishing scams and unauthorized transactions. By making an informed decision, you can ensure that the Cash App card is a positive tool for your child’s financial education. Many parents find that how to get your child a Cash App card is a common question, and this guide aims to provide a clear and comprehensive answer.

Remember to continuously communicate with your child about responsible spending habits and online safety. Open communication is key to ensuring that they use the Cash App card wisely and avoid potential pitfalls. By working together, you can help your child develop a strong foundation for financial success.