Capital One Eno Review: Is This Virtual Assistant Worth It?

Capital One’s Eno is a virtual assistant designed to help Capital One cardholders manage their accounts and protect themselves from fraud. In this comprehensive Capital One Eno review, we will delve into its features, benefits, drawbacks, and overall effectiveness to determine if it’s a valuable tool for managing your finances.

What is Capital One Eno?

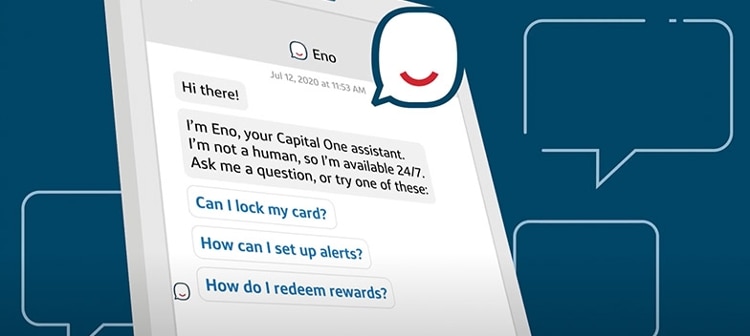

Capital One Eno is a free virtual assistant that works through text messages and the Capital One mobile app. It’s designed to help users monitor their spending, check their balances, and receive real-time fraud alerts. Eno is named after “one” spelled backward, symbolizing Capital One’s commitment to putting customers first.

Key Features of Capital One Eno

Eno boasts a range of features aimed at simplifying financial management and enhancing security. Let’s examine some of its most notable capabilities:

- Real-Time Fraud Alerts: Eno immediately notifies you of suspicious activity on your Capital One card, allowing you to quickly confirm or deny transactions.

- Balance Checks: You can quickly check your account balances by texting Eno.

- Spending Monitoring: Eno tracks your spending habits and provides insights into where your money is going.

- Transaction Information: Get detailed information about recent transactions, including merchant names and locations.

- Virtual Card Numbers: Generate virtual card numbers for online shopping to protect your actual card details.

- Bill Payment Reminders: Eno can remind you when your bills are due, helping you avoid late fees.

How to Set Up and Use Capital One Eno

Setting up Capital One Eno is a straightforward process:

- Enroll in Online Access: Ensure you have online access to your Capital One account.

- Download the Capital One Mobile App: If you haven’t already, download the Capital One mobile app from the App Store or Google Play.

- Enable Eno: Within the app, navigate to the Eno settings and enable the feature.

- Verify Your Phone Number: Follow the prompts to verify your phone number for text message alerts.

Once set up, you can interact with Eno through text messages or within the Capital One mobile app. Simply text commands like “Balance,” “Recent Transactions,” or “Virtual Card Number” to receive the requested information.

The Benefits of Using Capital One Eno

There are several advantages to using Capital One Eno:

- Enhanced Security: Real-time fraud alerts and virtual card numbers significantly reduce the risk of unauthorized transactions.

- Convenience: Accessing account information and managing transactions is quick and easy via text message or the mobile app.

- Improved Financial Awareness: Spending monitoring and bill payment reminders help you stay on top of your finances.

- Free Service: Eno is a free service for Capital One cardholders, adding value without any additional cost.

Potential Drawbacks of Capital One Eno

While Capital One Eno offers many benefits, there are also some potential drawbacks to consider:

- Limited Functionality: Eno’s capabilities are limited to basic account management and fraud protection. It doesn’t offer advanced financial planning tools.

- Dependence on Text Messages: Some users may find it inconvenient to manage their finances via text message.

- Potential for False Alarms: Fraud alerts can sometimes be triggered by legitimate transactions, requiring you to verify the activity.

Capital One Eno vs. Other Virtual Assistants

Compared to other virtual assistants like Siri or Google Assistant, Capital One Eno is specifically tailored for financial management. While general-purpose assistants can perform a wide range of tasks, Eno focuses on providing account information, fraud protection, and spending insights. This specialization makes Eno a valuable tool for Capital One cardholders who want to proactively manage their finances.

Real-World Examples of Eno in Action

Consider these scenarios to illustrate how Capital One Eno can be beneficial:

- Fraud Prevention: You receive a text message alert from Eno about a suspicious transaction. You quickly confirm that you didn’t make the purchase, and Eno immediately freezes your card to prevent further unauthorized activity.

- Budgeting: You use Eno to track your spending and identify areas where you can cut back. This helps you stay within your budget and achieve your financial goals.

- Convenient Balance Checks: You’re at the store and want to check your available credit. You simply text “Balance” to Eno and receive an immediate response.

Is Capital One Eno Secure?

Capital One Eno utilizes encryption and other security measures to protect your financial information. However, it’s essential to be aware of potential phishing scams and avoid sharing sensitive information via text message or email. Always access Eno through the official Capital One mobile app or website to ensure your security.

Customer Reviews and Ratings

Customer reviews of Capital One Eno are generally positive, with many users praising its real-time fraud alerts and convenience. Some users have reported occasional issues with the accuracy of transaction information, but overall, Eno is well-regarded as a valuable tool for managing Capital One accounts.

Tips for Maximizing Your Eno Experience

To get the most out of Capital One Eno, consider these tips:

- Customize Your Alerts: Adjust your alert preferences to receive notifications that are most relevant to you.

- Regularly Monitor Your Transactions: Use Eno to regularly review your transactions and identify any suspicious activity.

- Utilize Virtual Card Numbers: Use virtual card numbers for online shopping to protect your actual card details.

- Stay Informed: Keep up-to-date with the latest features and updates to Eno to take full advantage of its capabilities.

The Future of Capital One Eno

Capital One is continuously working to improve Capital One Eno and add new features. Future updates may include enhanced financial planning tools, personalized recommendations, and integration with other financial services. As technology evolves, Eno is likely to become an even more powerful tool for managing your finances.

Conclusion: Is Capital One Eno Worth It?

In conclusion, Capital One Eno is a valuable virtual assistant for Capital One cardholders. Its real-time fraud alerts, convenient balance checks, and spending monitoring capabilities make it a worthwhile tool for managing your finances and protecting yourself from fraud. While it has some limitations, the benefits of using Eno far outweigh the drawbacks, especially considering that it’s a free service. If you’re a Capital One cardholder, enabling Eno is a smart way to enhance your financial security and awareness.

Ultimately, this Capital One Eno review concludes that this virtual assistant is a beneficial tool for Capital One customers seeking to proactively manage their accounts and safeguard against fraud. The features offer convenience and security, making it a worthwhile addition to your financial management toolkit.

[See also: Capital One Credit Card Rewards Explained]

[See also: Best Capital One Credit Cards for Travel]

[See also: How to Dispute a Charge on Your Capital One Card]