Decoding Paradigm Fund Performance: A Comprehensive Analysis

Investors are constantly seeking reliable avenues for wealth creation and preservation. Among the myriad of investment options available, funds managed by firms like Paradigm stand out. Understanding Paradigm Fund Performance is crucial for both existing and prospective investors. This article delves into a comprehensive analysis of Paradigm’s fund performance, examining key metrics, historical data, and factors influencing its returns. We aim to provide a clear, data-driven perspective to help you make informed investment decisions.

Understanding Paradigm and Its Investment Philosophy

Paradigm, as an investment firm, likely operates under a specific investment philosophy. This could range from value investing to growth investing, or a blend of both. Understanding their approach is paramount in evaluating their fund performance. For example, a value-oriented fund may underperform in bull markets but shine during market corrections. Conversely, a growth-focused fund might deliver high returns during economic expansions but face greater volatility in downturns.

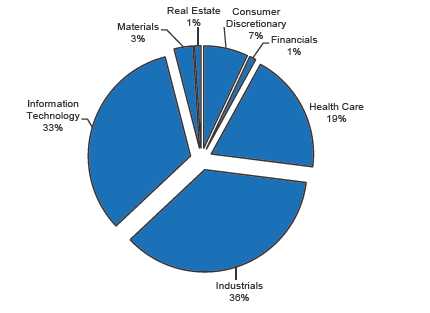

The firm’s investment strategy also dictates the types of assets they invest in, such as stocks, bonds, real estate, or alternative investments. Diversification across asset classes is a common strategy to mitigate risk, but the specific allocation will significantly impact Paradigm Fund Performance.

Key Metrics for Evaluating Fund Performance

Several key metrics are essential for evaluating Paradigm Fund Performance. These include:

- Total Return: This is the overall gain or loss generated by the fund over a specific period, including both capital appreciation and income (dividends or interest). Comparing total returns over different timeframes (e.g., 1-year, 3-year, 5-year, and 10-year) provides a more complete picture.

- Benchmark Comparison: How does the fund’s performance compare to its benchmark index (e.g., S&P 500, MSCI World)? Outperforming the benchmark indicates strong management and investment selection.

- Risk-Adjusted Returns: Metrics like Sharpe Ratio, Treynor Ratio, and Jensen’s Alpha consider the level of risk taken to achieve those returns. A higher Sharpe Ratio, for instance, suggests better returns for the level of risk assumed.

- Expense Ratio: This is the annual fee charged to manage the fund, expressed as a percentage of assets under management (AUM). A lower expense ratio means more of your investment returns are retained.

- Turnover Rate: This measures how frequently the fund buys and sells its holdings. A high turnover rate can lead to higher transaction costs, potentially impacting returns.

- Alpha and Beta: Alpha measures the fund’s excess return relative to its benchmark, while Beta measures its volatility compared to the market. A positive Alpha suggests the fund is outperforming its benchmark, while a Beta greater than 1 indicates higher volatility.

Analyzing Historical Paradigm Fund Performance

A thorough analysis of historical Paradigm Fund Performance is crucial. This involves examining past returns during various market cycles – bull markets, bear markets, and periods of economic uncertainty. Consistency in performance is a positive indicator, suggesting a well-defined and disciplined investment process.

However, past performance is not necessarily indicative of future results. It’s essential to consider the context of the market environment during those periods. For example, a fund that performed exceptionally well during a tech boom may not replicate that performance in a different market landscape.

Factors Influencing Paradigm Fund Performance

Several factors can influence Paradigm Fund Performance, including:

- Market Conditions: Overall market trends, economic growth, interest rates, and inflation all play a significant role.

- Investment Strategy: The fund’s investment approach, asset allocation, and security selection decisions directly impact returns.

- Fund Manager Expertise: The skills and experience of the fund manager are critical. Their ability to identify promising investment opportunities and manage risk effectively can significantly influence performance.

- Company-Specific Factors: For funds that invest in individual stocks, the performance of those companies will impact the fund’s returns.

- Regulatory Changes: Changes in regulations can affect certain industries or asset classes, impacting fund performance.

- Geopolitical Events: Global events, such as political instability or trade wars, can create market volatility and influence investment returns.

Comparing Paradigm Fund Performance to Competitors

Benchmarking Paradigm Fund Performance against its peers is crucial. This involves comparing its returns, risk-adjusted returns, expense ratios, and other relevant metrics to similar funds in the same investment category. This comparative analysis provides a better understanding of whether Paradigm’s fund is delivering competitive results.

Consider factors such as the fund’s size, investment style, and geographic focus when making comparisons. A small-cap fund, for instance, should not be directly compared to a large-cap fund.

Case Studies: Examining Specific Paradigm Funds

To illustrate the analysis process, let’s consider hypothetical examples of specific Paradigm funds:

Paradigm Growth Fund

This fund focuses on investing in high-growth companies across various sectors. Its historical performance has been strong during periods of economic expansion, but it has experienced greater volatility during market downturns. Its expense ratio is slightly above average compared to its peers. Analyzing the specific holdings of the fund can reveal its exposure to particular industries and companies.

Paradigm Value Fund

This fund invests in undervalued companies with strong fundamentals. Its performance has been more consistent over time, with lower volatility compared to the growth fund. Its expense ratio is below average. This fund may be suitable for investors seeking a more conservative approach.

Paradigm International Fund

This fund invests in companies outside of the domestic market. Its performance is influenced by global economic trends and currency fluctuations. It may offer diversification benefits but also carries additional risks associated with international investing. Understanding the fund’s geographic allocation is critical.

The Role of Risk Management in Paradigm Fund Performance

Effective risk management is integral to achieving sustainable Paradigm Fund Performance. This involves identifying, assessing, and mitigating various risks, such as market risk, credit risk, and liquidity risk. A well-defined risk management framework helps to protect investors’ capital and minimize potential losses.

Fund managers employ various techniques to manage risk, including diversification, hedging, and setting stop-loss orders. Understanding their risk management approach is essential for evaluating the fund’s overall stability and potential for long-term success.

Future Outlook for Paradigm Fund Performance

Predicting future Paradigm Fund Performance is challenging, as it depends on a multitude of factors. However, by analyzing current market trends, economic forecasts, and the fund’s investment strategy, it is possible to develop a reasonable outlook. Consider factors such as:

- Economic Growth: Expected economic growth rates in different regions.

- Interest Rate Environment: The direction of interest rates and their potential impact on asset valuations.

- Inflation: Inflationary pressures and their effect on corporate earnings.

- Geopolitical Risks: Potential geopolitical events that could disrupt markets.

- Technological Advancements: The impact of new technologies on various industries.

Making Informed Investment Decisions

Ultimately, the decision to invest in a Paradigm fund should be based on a thorough understanding of its investment philosophy, historical performance, risk profile, and future outlook. Consult with a qualified financial advisor to determine if the fund aligns with your individual investment goals and risk tolerance.

Don’t solely rely on past performance. Consider the factors that may influence future returns and make informed decisions based on your own research and due diligence. Remember that all investments carry risk, and there is no guarantee of future profits. Diversifying your portfolio across different asset classes and investment strategies can help to mitigate risk and improve long-term investment outcomes. Understanding the nuances of Paradigm Fund Performance is a key step in building a well-rounded investment strategy.

[See also: Understanding Mutual Fund Performance Metrics]

[See also: Choosing the Right Investment Fund for Your Goals]

[See also: How to Analyze Financial Statements of Public Companies]